Easy Accessibility to Medicare Conveniences: Medicare Supplement Plans Near Me

Exactly How Medicare Supplement Can Enhance Your Insurance Policy Insurance Coverage Today

As individuals navigate the ins and outs of medical care strategies and look for thorough defense, recognizing the subtleties of supplemental insurance becomes significantly important. With an emphasis on linking the voids left by typical Medicare strategies, these supplementary alternatives use a customized technique to meeting particular needs.

The Fundamentals of Medicare Supplements

Medicare supplements, also referred to as Medigap strategies, give additional protection to load the gaps left by original Medicare. These auxiliary plans are offered by personal insurer and are developed to cover costs such as copayments, coinsurance, and deductibles that are not totally covered by Medicare Component A and Part B. It's necessary to keep in mind that Medigap plans can not be utilized as standalone plans but work together with initial Medicare.

One trick aspect of Medicare supplements is that they are standard throughout most states, providing the exact same fundamental advantages despite the insurance policy company. There are 10 various Medigap strategies classified A through N, each giving a different degree of insurance coverage. Plan F is one of the most comprehensive options, covering almost all out-of-pocket prices, while various other strategies might use a lot more restricted protection at a reduced premium.

Comprehending the basics of Medicare supplements is important for individuals approaching Medicare eligibility who wish to boost their insurance policy protection and minimize prospective monetary concerns connected with healthcare expenses.

Understanding Insurance Coverage Options

Discovering the varied variety of protection alternatives offered can offer useful insights into supplementing health care expenditures successfully. When considering Medicare Supplement prepares, it is critical to understand the various insurance coverage options to make sure thorough insurance security. Medicare Supplement intends, also understood as Medigap plans, are standard across many states and identified with letters from A to N, each offering differing degrees of coverage. These plans cover copayments, coinsurance, and deductibles that Original Medicare does not completely spend for, giving recipients with financial safety and security and comfort. In addition, some strategies may offer protection for services not included in Original Medicare, such as emergency situation treatment throughout international traveling. Understanding the coverage choices within each plan kind is essential for individuals to select a policy that aligns with their particular health care demands and spending plan. By meticulously assessing the coverage options available, beneficiaries can make informed decisions to enhance their insurance coverage and effectively manage healthcare costs.

Benefits of Supplemental Plans

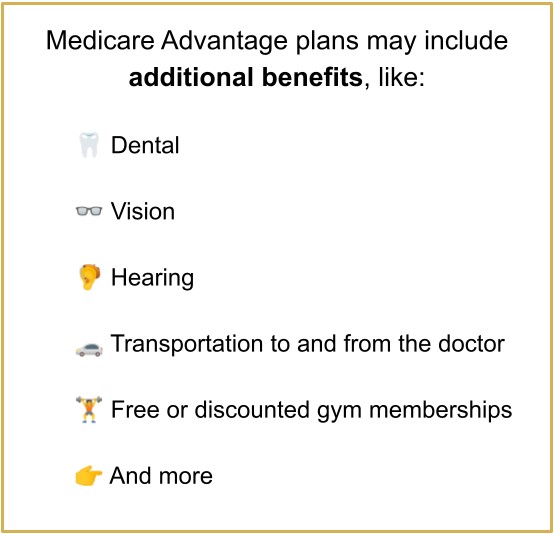

In addition, supplemental plans offer a wider variety of insurance coverage alternatives, consisting of accessibility to medical care providers that may not accept Medicare assignment. One more advantage of additional plans is the ability to travel with tranquility of mind, as some strategies supply insurance coverage for emergency situation clinical solutions while abroad. Generally, the benefits of additional plans contribute to a more thorough and customized strategy to medical care protection, making sure that individuals can receive the treatment they need without facing frustrating economic problems.

Expense Considerations and Financial Savings

Offered the monetary safety and security and broader coverage alternatives supplied by additional plans, an essential facet to take into consideration is the expense considerations and potential financial savings they use. While Medicare Supplement plans call for a month-to-month premium along with the typical Medicare Part B premium, the benefits of decreased out-of-pocket costs typically exceed the added cost. When assessing the price of extra plans, it is vital to compare costs, deductibles, copayments, and coinsurance across various plan kinds to identify one of the most affordable alternative based on private medical care requirements.

In addition, selecting a strategy that aligns with one's health and wellness and financial demands can lead to substantial cost savings with time. By selecting a Medicare Supplement plan that covers a greater percentage of health care expenditures, individuals can minimize unforeseen prices and budget better for treatment. In addition, some extra plans provide house discounts or rewards for healthy and balanced actions, giving more chances for price financial savings. Medicare Supplement plans near me. Inevitably, spending in a Medicare Supplement plan can supply valuable financial defense and assurance for beneficiaries looking for detailed protection.

Making the Right Selection

Picking one of the most appropriate click over here Medicare Supplement strategy requires careful consideration of individual medical care demands and monetary scenarios. With a range of plans available, it is essential to assess factors such as protection choices, premiums, out-of-pocket costs, service provider networks, and overall worth. Recognizing your present health standing and any type of anticipated clinical demands can assist you in selecting a plan that supplies detailed protection for services you might need. Furthermore, reviewing your budget plan restraints and contrasting premium expenses amongst different strategies can help ensure that you pick a plan that is affordable in the lengthy term.

Verdict